It is calculated by getting the difference between the par value of common stock and the par value of preferred stock, the selling price, and the number of newly sold shares. The liabilities represent the amount owed by the owner to lenders, creditors, investors, and other individuals or institutions who contributed to the purchase of the asset. The only difference between owner’s equity and shareholder’s equity is whether the business is tightly held (Owner’s) or widely held (Shareholder’s). For a homeowner, equity would be the value of the home less any outstanding mortgage debt or liens. Equity is the value remaining from a company’s assets after all liabilities have been subtracted. For example, if a business buys a piece of equipment valued at $20,000, but purchases it with a loan totaling $15,000, the equity in the equipment is the difference between the asset and the liability — in this case, $5,000.

Raw materials, like products and workers’ labor, go into the machine, and the machine works its magic adding value to the inputs. Let’s assume that Jake owns and runs a computer assembly plant in Hawaii and he wants to know his equity in the business. Jake’s balance sheet for the previous year shows that the warehouse premises are valued at $1 million, the factory equipment is valued at $1 million, inventory is valued at $800,000 and that debtors owe the business $400,000. The balance sheet also indicates that Jake owes the bank $500,000, creditors $800,000 and the wages and salaries stand at $800,000.

AccountingTools

These private equity investors can include institutions like pension funds, university endowments, insurance companies, or accredited individuals. Shareholder equity can also be expressed as a company’s share capital and retained earnings less the value of treasury shares. Though both methods yield the exact figure, the use of total assets and total liabilities is more illustrative of a company’s financial health. The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business. The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet. The owner’s equity is always indicated as a net amount because the owner(s) has contributed capital to the business, but at the same time, has made some withdrawals.

Cash flows or the assets of the company being acquired usually secure the loan. Mezzanine debt is a private loan, usually provided by a commercial bank or a mezzanine What Is Owners Equity? venture capital firm. Mezzanine transactions often involve a mix of debt and equity in a subordinated loan or warrants, common stock, or preferred stock.

Terms Similar to Owners’ Equity

Understanding the components of owner’s equity is important for evaluating the financial performance of a business, as well as for making strategic decisions related to growth, financing, and operations. On a concluding thought, we can say that owner’s equity is the money of the owners, which grows only if the business flourishes. So, the owners have to only focus on increasing the business & controlling the costs. Because owners are exposed to ample risks like industry risk, product risk, finance risk, etc., they have to deal with all to flourish the venture. You can compare balance sheets from different accounting periods to determine whether your owner’s equity is increasing or decreasing. The balance sheet is a type of financial statement that shows your business’s performance during a specific time.

How do we calculate owner’s equity?

Owners Equity Formula

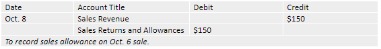

Owner's Equity = Assets – Liabilities. Assets, liabilities and subsequently the owner's equity can be derived from a balance sheet.

Due to the cost principle (and other accounting principles) the amount of owner’s equity should not be considered to be the fair market value of the business. For example, a partnership of two people might split the https://kelleysbookkeeping.com/bookkeeper-hourly-pay-at-hobby-lobby-inc/ ownership 50/50 or in other percentages as stated in the partnership agreement. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Owners’ Equity vs. Business Fair Value

For example, if a business buys a piece of equipment valued at $20,000, but purchases it with a $15,000 loan, the owner’s equity in the equipment is the difference between the asset and the liability — in this case, $5,000. An easy way to understand retained earnings is that it’s the same concept as owner’s equity except it applies to a corporation rather than a sole proprietorship or other business types. Net earnings are cumulative income or loss since the business started that hasn’t been distributed to the shareholders in the form of dividends. The statement of retained earnings shows whether the company had more net income than the dividends it declared. The closing balances on the statement of owner’s equity should match the equity accounts shown on the company’s balance sheet for that accounting period.

Treasury stock refers to the number of stocks that have been repurchased from the shareholders and investors by the company. The amount of treasury stock is deducted from the company’s total equity to get the number of shares that are available to investors. Outstanding shares refers to the amount of stock that had been sold to investors but have not been repurchased by the company. The number of outstanding shares is taken into account when assessing the value of shareholder’s equity. Shareholders’ equity is, therefore, essentially the net worth of a corporation.

What is owner’s equity?

If you look at the balance sheet, you can see that the total owner’s equity is $95,000. That includes the $20,000 Rodney initially invested in the business, the $75,000 he took out of the company, and the $150,000 of profits from this year’s operations. All business types (sole proprietorships, partnerships, and corporations) use owner’s equity, but only sole proprietorships name the balance sheet account “owner’s equity.” It provides important information about a company’s financial health and its ability to meet its financial obligations. It is used to calculate the debt-to-equity ratio and the return on equity ratio, both of which are important metrics for assessing a company’s financial risk and potential for growth.

Exclusive: Francisco Partners, TPG end talks to buy New Relic – Reuters.com

Exclusive: Francisco Partners, TPG end talks to buy New Relic.

Posted: Fri, 26 May 2023 17:52:00 GMT [source]

Negative brand equity is rare and can occur because of bad publicity, such as a product recall or a disaster. Owner’s equity represents the owner’s investment in the business minus the owner’s draws or withdrawals from the business plus the net income (or minus the net loss) since the business began. Equity interest refers to the share of a business owned by an individual or another business entity. For example, a stockholder with a 20% equity interest owns 20% of the business. To further illustrate owner’s equity, consider the following two hypothetical examples.

What’s included in owner’s equity?

Let’s say your business has assets worth $50,000 and you have liabilities worth $10,000. Using the owner’s equity formula, the owner’s equity would be $40,000 ($50,000 – $10,000). Because liabilities must be paid off first, they take priority over owner’s equity.

- Equity can also be illustrated by looking at what happens when a company liquidates its assets.

- If a 2-liter bottle of store-brand cola costs $1 and a 2-liter bottle of Coke costs $2, then Coca-Cola has brand equity of $1.

- Also, if a business must be sold on short notice (perhaps due to its impending bankruptcy), then the reduced number of bidders will generally reduce the price at which the business can be sold.

- Owner’s equity (also referred to as net worth, equity, or net assets) is the amount of ownership you have in your business after subtracting your liabilities from your assets.

Owner’s equity can also be viewed (along with liabilities) as a source of the business assets. Owner’s equity is essentially the owner’s rights to the assets of the business. It’s what’s left over for the owner after you’ve subtracted all the liabilities from the assets. The above format may also be called as statements of changes in equity (SOCE).