Contents:

https://1investing.in/ budgets can also be used after an accounting period to evaluate the successful areas and unsuccessful areas of the last period performance. Management carefully compares the budgeted numbers with the actual performance statistics to see where the company improved and where the company needs more improvement. The more sophisticated relative of the static budget model, a flexible budget allows for change, and as we’ve said – business can be unpredictable. Changing costs in the manufacturing process can severely impact your profit margin.

Let us consider the following information regarding the costs that are expected to be incurred by a company in the upcoming accounting period. The company wants to prepare a flexible budget based on an expected activity level of 70% of the production capacity. The number of units that can be prepared at this production capacity is 7000 units.

The Difference Between Static and Flexible Budgets

Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Sales increase, but commissions do not increase at a similar rate, since the commissions are based on cash received, which has a 30-day time lag. Though the flex budget is a good tool, it can be difficult to formulate and administer.

The business can then use the figures from the three budgets to create a new one for the following year. Costs that are below budget are good, as they are considered favorable as long as they implement the correct scenario for the volume. A company makes a budget for the smallest time period possible so that management can find and adjust problems to minimize their impact on the business. Everything starts with the estimated sales, but what happens if the sales are more or less than expected? What adjustments does a company have to make in order to compare the actual numbers to budgeted numbers when evaluating results? If production is higher than planned and has been increased to meet the increased sales, expenses will be over budget.

- As opposed to 22,750 customers, there are only 15,925, bringing revenue down to $47,775.

- In the case of a business that carries its entire work with the help of laborers.

- This means there is an unfavorable flexible budget variance related to the cost of goods sold of $4,000 (calculated as 800 units x $5 per unit).

- Jake is now working on a flexible budget for his sales department!

- Managers use a flexible budget system to set financial targets for their department and track progress towards those goals.

Companies develop a budget based on their expectations for their most likely level of sales and expenses. Often, a company can expect that their production and sales volume will vary from budget period to budget period. They can use their various expected levels of production to create a flexible budget that includes these different levels of production. Then, they can modify the flexible budget when they have their actual production volume and compare it to the flexible budget for the same production volume.

What is a flexible budget?

If you manufacture products, see how a flexible budget can help your business. To prepare a flexible budget, you need to have a master budget, really understand cost behavior, and know the actual volume of goods produced and sold. \nTo prepare a flexible budget, you need to have a master budget, really understand cost behavior, and know the actual volume of goods produced and sold. If sales declined to $150,000 per month, then labor cost should be reduced to $37,500 (25 percent of $150,000). A static budget would not adjust to the decline in revenues and would keep labor costs at the original level. Flexible budgets have a reputation for being more time-consuming than other budgeting models.

- Of course, if you sell 18,000 less units, you would expect profit to be less – this is where the flexible budget comes in.

- Static budgets are often used by non-profit, educational, and government organizations.

- The formula to create the flexible budget can be difficult to use.

- Variable costs assigned to sales activity or in percentage terms provide greater flexibility in profit analysis.

Revised budgets may not still be accurately updated and actual results May fall short which results in a low staff morale. If the company performs well and reaches an above-target performance, it will have a favorable variance of $90,625. If the company performs below targets and produces only 75% of the units they will produce an adverse variance of -$181,250. If you don’t want to spend hours tracking and forecasting your budget in spreadsheets, check out our financial modeling tool. Finmark is everything you need to build an accurate, customized financial model.

What Are the Pros and Cons of Flexible Budgets?

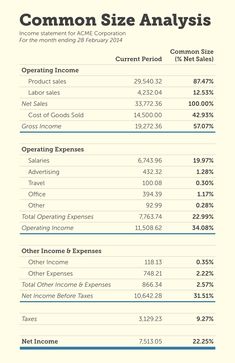

The flexible budget uses the same selling price and cost assumptions as the original budget. The variable amounts are recalculated using the actual level of activity, which in the case of the income statement is sales units. A budget report is prepared to show how actual results compare to the budgeted numbers. It has columns for the actual and budgeted amounts and the differences, or variances, between these amounts. On an income statement budget report, think of how the variance affects net income, and you will know if it is a favorable or unfavorable variance.

encumbrance accounting expenses are lower because the income before income taxes was lower. In conclusion, the budget that companies can prepare for multiple output levels is a Flexible Budget. Practically, managers widely use this type of budget as it is the most realistic one.

In Chapter 9, Using budgets to evaluate performance, we discussed the idea of a flexible budget – the restating of our original budget, but using the sales quantities that were actually recorded. The first is the static budget – our original budget – labelled static because it does not move or change. We use our projected sales quantities and prices, materials, labour and overhead to generate our budgeted profit. The second budget is our flexible budget – using all of the same assumptions about sales price, cost of raw materials and cost of labour – but adjusted for the actual units sold.

Why Is the IMF Being Flexible on Argentina’s Loan Program? – Foreign Policy

Why Is the IMF Being Flexible on Argentina’s Loan Program?.

Posted: Fri, 14 Apr 2023 12:02:40 GMT [source]

In addition, the model contains an assumption that the cost of goods sold per unit will be $45. This means there is an unfavorable flexible budget variance related to the cost of goods sold of $4,000 (calculated as 800 units x $5 per unit). In aggregate, this works out to an unfavorable variance of $2,400. Variances can be calculated based on the revised budget and the actual performance. Unlike a static budget, a flexible budget changes or fluctuates with changes in sales, production volumes, or business activity.

Compare the flexible budget to actual results

If you own an ice cream shop, you know that the height of your business will be in the warm summer months. Using a flexible budget allows you to account for increased revenues, higher labor costs, and higher inventory costs during the busier months without having to adjust for months when business is slower. For example, your master budget may have assumed that you’d produce 5,000 units; however, you actually produce 5,100 units. The flexible budget rearranges the master budget to reflect this new number, making all the appropriate adjustments to sales and expenses based on the unexpected change in volume. \nFor example, your master budget may have assumed that you’d produce 5,000 units; however, you actually produce 5,100 units.

The AICPA urges its members to be the forerunners in the sustainability reporting movement by elevating its credibility. Therefore, in our next article, additional issues in the implementation of the flexible budgeting approach for measuring efficiency improvements will be explored. Identify the variable costs that are to be incurred and determine the variable cost on a per-unit basis or as a percentage of activity level. Unlike a static budget, a flexible budget changes or fluctuates with changes in sales and production volumes. Let’s say Green Company estimates their total production capacity to be 250,000 units. The direct material and labor costs per unit are $4.50 and $2.50 respectively.

A flexible budget lets you adjust to global trends and economic changes rather than trying to anticipate when those will happen . Flexible budgeting is a dynamic budgeting model that allows you to adjust to changes in costs and revenue in real time. But don’t get caught up in comparing this type of budget to other types. What’s more important is to apply the principles to certain parts of your budget. Discover the definition of flexible budgeting, flexible budget formulas, and how to find a flexible budget variance.

That’s why SaaS companies might make a connection between an AWS budget line item and the assumption for customer growth. While there is not specific equation or formula for the flexible budget, it uses the same basic method. A business generally uses a percentage or range of numbers to show the flex within the budget, which then creates budget scenarios based on other activities. The flexible budget can be categorized into three different types. These include the basic flexible budget, intermediate flexible budget, and the advanced flexible budget.