Contents:

Most can be classified as strong, or weak by their association to the Kumo . Also called leading span 2, this line forms the other edge of the kumo. The average of the highest high and the lowest low over the last 52 days, plotted 26 days ahead.

Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. 3, 6, 9, 12 months EMI options are available for all credit card holders. The stop-loss is usually set outside the boundary of the cloud opposite the direction of the entrance. For example, if we are working on breaking the clouds from the bottom up, then we place the stop-loss below the lower boundary of the cloud, and if from the top down – then above the cloud.

- Here, the cloud showcases entry opportunities into the trend.

- Analysis of Ichimoku in different timeframes can give you the bigger picture of the market.

- The Japanese journalist wanted to make investment super simple by launching a technical indicator that could help them ascertain the price movements, resistance and support levels, momentum, trends, and so on.

- You can automatically add the Ichimoku cloud indicator to your calculation chart to get the results.

- But, that happens only in the case of strong trends, when the first test often works, traders use the right risk-reward ratio.

- First, notice that BLUESTARCO broke Cloud support in mid March.

The term “Ichimoku” can be translated from Japanese as “instant view” or “one look”, “Kinko” is the equivalent of “balance”, and “Hyo” means “chart”. Therefore, the full name of the indicator “Ichimoku Kinko Hyo” actually means “one look at the chart cloud”. Where is the golden mean, which can allow you to achieve harmony between a reasonable risk and a sufficient amount of winnings? One of them is trading using the Ichimoku Kinko Hyo indicator. When Cloud turns from red to green, it will generate a Buy Signal and when Cloud turns from green to red, it will generate a Sell Signal. Meanwhile, the Kijun Sen acts as an indicator of future price movement.

ICHIMOKU KINKO HYO

In a broad sense, the intersection of Tenkan-sen above Kijun-sen is a bullish sign, and the intersection of Tenkan-sen below Kijun-sen is a bearish sign. The Ichimoku Cloud helps traders to characterize support and resistance, price momentum, determine trading signals etc… , all in one. Also called the lagging span it is used as a support/resistance aid. For a bullish signal this trading strategy sets three criteria. First, the trend is bullish when prices reach above the lowest line of the cloud. Second, a bullish signal triggers when prices reverse and reach above the Conversion Line.

Hendra received his B.S.B.A from the Ohio State University and his M.B.A from Carnegie Mellon University. He has over 10 years of experience in trading financial market using Elliott Wave Theory and regularly contribute articles and analysis to financial media such as forexstreet and investing.com. Hosoda also emphasized that his indicator is the development of candle theory.

Meanwhile, if the conversion line falls below the baseline and then rallies back above it, it depicts a long entry. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties. Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Investments in securities market are subject to market risk, read all the related documents carefully before investing.

It is recommended to maintain a certain reserve of about 5-10 points to exclude the possibility of false triggering on volatile movement. After changing the boundaries of the cloud, it is recommended to move the stop-loss of your order. If all lines of the indicator are aligned in a hierarchical sequence, then the signals for clearing are combined by the concept of “three-line signal”.

An Introductory Guide on Ichimoku Cloud

This indicator is exactly like the original ichimoku indicator, but with 104 Line , 208 Line , Quality Line and Tenken-sen & Kijun-sen crossovers added as well. The extras added to the indicator can simply be hidden in order to make the chart look less full. However, traders will have to control risk with a stop loss and must find a way to exit trades successfully. Once broken down, every trader will find Ichimoku Cloud beneficial. Ichimoku Cloud is quite a helpful indicator, especially for the new traders who want some help in gauging the trend direction, finding entry points, spot trend reversals, and momentum. Keep in mind that when checking the historical price, the time when the cloud turns correct to a price level 26 periods ahead.

What Is the Ichimoku Cloud Technical Analysis Indicator? – Investopedia

What Is the Ichimoku Cloud Technical Analysis Indicator?.

Posted: Sat, 25 Mar 2017 21:10:16 GMT [source]

When you see the Leading Span A above the Leading Span B, you can colour the cloud in green. Conversely, if the Leading Span A appears below the Leading B, you can colour the cloud in red. You will now notice the difference between Span A and B is coloured in, which in turn creates the Ichimoku cloud. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors.

You are unable to access stockmaniacs.net

In this investopedia sharper insight higher investing, time is considered as a crucial Factor that has a great impact on the price movement and trends. Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Calculator needs a reset button, it’s like loop structure. Plot percentages which it compare closing price and Target Value on a… Please read the scheme information and other related documents carefully before investing. Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs.

We will also talk about some challenges which hold new traders back and the importance of having the right kind of knowledge before trading. The team at NiftyTrader.in is always endeavoring to improve education about technical analysis approach to decipher the movement of stock market. Ichimoku Kinko Hyo is an indicator that gauges future price momentum and determines future areas of support and resistance. Also know that this indicator is mainly used on JPY pairs.

You may also hold the trade until the conversion line drops below the baseline while using any other line as an exit point. The Ichimoku indicator offers more data points than those provided by a standard candlestick chart. Although the charts may appear quite complicated in the beginning, once you learn how to read them, they become increasingly familiar, and you can decode them easily with properly defined trading signals. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate.

https://1investing.in/ing the line of the Senkou Span B line is the strongest signal for entering the market . Classical settings of Ichimoku ( ) when trading on H1 cover about half a week’s cycle and, so they can be freely used. But still, with sharp price movements during the day, Ichimoku decently loses on the forecasts accuracy.

Traditions and customs of the samurai were formed over the centuries. That’s what we owe to the appearance of one of the first theories of trading in the market, namely candlestick analysis. Lastly, if the Chikou Span or the green line crosses the price in the bottom-up direction, that’s a buy signal. If the green line crosses the price from the top-down, that’s a sell signal. During an uptrend, the price often bounces off the cloud during pullback and then resumes towards the uptrend. At the same time, when a downtrend is in order, the price retraces to the cloud and continues to the lower side of the market.

Ichimoku Cloud Definition

Therefore, the author does not recommend opening the position, if there are candle patterns that contradict the main signal. It is also very good if the signal is further confirmed by a candlestick pattern. Moreover, when trading bounces from the Ichimoku lines, the presence of a candle pattern is a prerequisite. If the price breaks the bottom line of the cloud downwards, it is a signal to sell, if the top line is crossed upwards – it a signal to buy. Japan is an ancient civilization with its way of life and approach to life, a measured and unhurried flow of time.

When it goes horizontally – the market entered the channel. Chinkou Span shows the closing price of the current candle, shifted back by the value of the second time interval. He created his system for trading contracts on the Nikkei index. It turned out that the main advantage of the mathematics of this indicator is that it makes it possible to distinguish the range from the trend, and at least, get a small profit from the trend.

Senkou Span B – The average of the highest high and lowest low over the last 52 days, plotted 26 days ahead. Ichimoku Cloud can look complicated, but basically, the idea is if the price is below the cloud, the trend is down. When the price reflects above the cloud, the trend is up.

This is the second element of the system, the long-term trend. A buy signal is generated when the Tenkan-Sen line crosses Kijun-sen from the bottom up. At the same time, for this type of signal there is even a name – a “gold cross” for purchases and a “dead cross” for sales. In general, this is the weakest signal given by the indicator. We will start our conceptual discussion with the kind of soft skills you need to build the right trading psychology mindset in the stock market – with the right discipline, experience and knowledge.

Forex – Trading Strategies, Robots, Indicators, Lessons

Kijun Sen – A moving average of the highest high and lowest low over the last 26 trading days. Tenkan Sen – A moving average of the highest high and lowest low over the last 9 trading days. In some instances, the 2nd and 3rd tests are good enough for a trade.

- Ichimoku Cloud is one such Japanese charting method that helps to identify the probable direction of the price and helps a trader to determine the most suitable time to enter and exit the market.

- Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market.

- With some examples of his real-life trades, Mr. Nagpal will discuss how we can draw and trace harmonic patterns over various situations in the stock market and how we can trade with them.

- Please type the verification code you have received in your registered email ID.

Understanding the cloud value projected in time, traders wait for the real price to reach the cloud before going short or long. If Chinkou Span is below the prices of 26 periods ago and there is a sell signal, then this is a stronger signal than it would be at the price position above the close of 26 periods ago. If the price is higher than this line, prices are likely to continue to grow. When the price crosses this line, a further trend change is likely.

What is Ichimoku Kinko Hyo?

If the second orange line exhibits the most top mark in the chart, it is an indication of an alarming downward trend. It uses a charting technique based on 52 days of highest and lowest points of the trade. It also provides some trend signals which allow you to predict upcoming trends of the price. It is a standalone trading system with an all-in-one set of indicators. Ichimoku Kinko Hyo, the full name of the Ichimoku cloud indicator translates to ‘one look equilibrium chart‘ which holds the essence of its functionality.

Here, the cloud showcases entry opportunities into the trend. The cloud projects at 26 price bars to the right of the current price facilitating an idea about where resistance and support may develop in the future. Before you want to explore the possibility of using Ichimoku Cloud, you should take a closer look at various inputs, so that you can have a better understanding of it. The chart is a combination of five lines, out of which there is one line each of red, blue, green colors and two lines of orange. The orange line will have a gradient or shade in between. Like any other trading, currency trading also has a substantial risk of loss, but the usage of some strategies may reduce the threat of such losses.

Ichimoku Kinko Hyo: what it is and how to use it – Capital.com

Ichimoku Kinko Hyo: what it is and how to use it.

Posted: Fri, 16 Mar 2018 07:00:00 GMT [source]

If the price is higher than the blue line, it could continue to climb higher. If the price is below the blue line, it could keep dropping. Could you kindly intervene and help me get the desired result? This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

Bit iPlex Codes Review 2023 – Is It Legit or a Scam? – BanklessTimes

Bit iPlex Codes Review 2023 – Is It Legit or a Scam?.

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

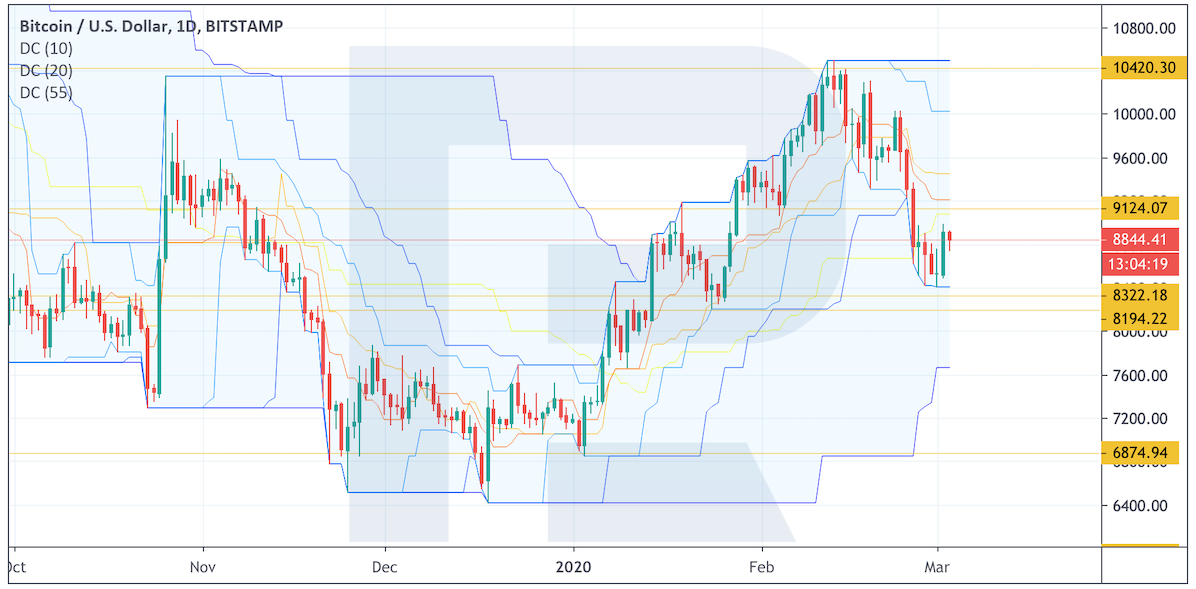

The first orange line represents the current average reading of the highest and lowest Tenkan Sen and Kijun Sen by charting 26 days to the right. Below chart shows an example of Ichimoku applied on BLUESTARCO. First, notice that BLUESTARCO broke Cloud support in mid March.